BDP Engbu Insights

Your go-to source for the latest news and insights.

Marketplace Liquidity Models: The Secret Sauce Behind Thriving Ecosystems

Unlock the secrets of marketplace liquidity models and discover the essential ingredients for thriving ecosystems in today's digital economy!

Understanding Marketplace Liquidity Models: Key Components for Success

Understanding marketplace liquidity models is essential for businesses aiming to thrive in competitive environments. Liquidity, in this context, refers to how easily assets can be bought or sold in a marketplace without affecting their price. There are several key components that influence liquidity, including the number of buyers and sellers, the depth of the market, and the overall market structure. A marketplace with a high volume of active participants often facilitates swift transactions, reducing the time and effort required to execute trades. Moreover, factors such as transaction fees and the presence of market makers can significantly enhance or hinder liquidity dynamics.

Furthermore, understanding different liquidity models can provide insights into how to optimize a marketplace for increased success. One common approach is the **Order Book Model**, where buyers and sellers place orders that are matched by the marketplace. Another model is the **Automated Market Maker (AMM)**, popular in decentralized finance, which uses algorithms to set prices based on supply and demand. Each model has its advantages and disadvantages, and recognizing these can help stakeholders tailor their strategies to improve liquidity and, ultimately, market performance. Comprehensive analysis and implementation of effective liquidity strategies can lead to sustained growth and profitability.

Counter-Strike is a highly popular first-person shooter game that pits teams of terrorists against counter-terrorists in various objective-based game modes. Players engage in tactical gameplay, utilizing teamwork and strategy to secure victory. For players looking to enhance their experience, there are various rewards and opportunities available, including daddyskins promo code that can provide additional in-game items and benefits.

How Marketplace Liquidity Influences Ecosystem Health: A Deep Dive

The health of any marketplace ecosystem hinges on its liquidity, which refers to how easily assets can be bought and sold without causing a significant impact on their prices. High liquidity typically means that there are plenty of buyers and sellers present, allowing for smoother transactions and contributing to a sense of stability within the market. On the other hand, low liquidity can lead to price volatility and may deter participants from engaging, leading to a stagnant ecosystem. In essence, marketplace liquidity ensures that users can enter and exit the market with minimal friction, thus fostering a vibrant trading environment.

Moreover, strong liquidity contributes not only to individual trading success but also to the overall health of the ecosystem. When liquidity is abundant, it encourages increased participation, which can lead to higher demand and subsequently drive innovation within the marketplace. For instance, a liquid marketplace is better equipped to accommodate new entrants, new products, and advanced technological solutions, ultimately benefiting all participants. Therefore, monitoring and optimizing liquidity is essential for maintaining a resilient and dynamic marketplace ecosystem.

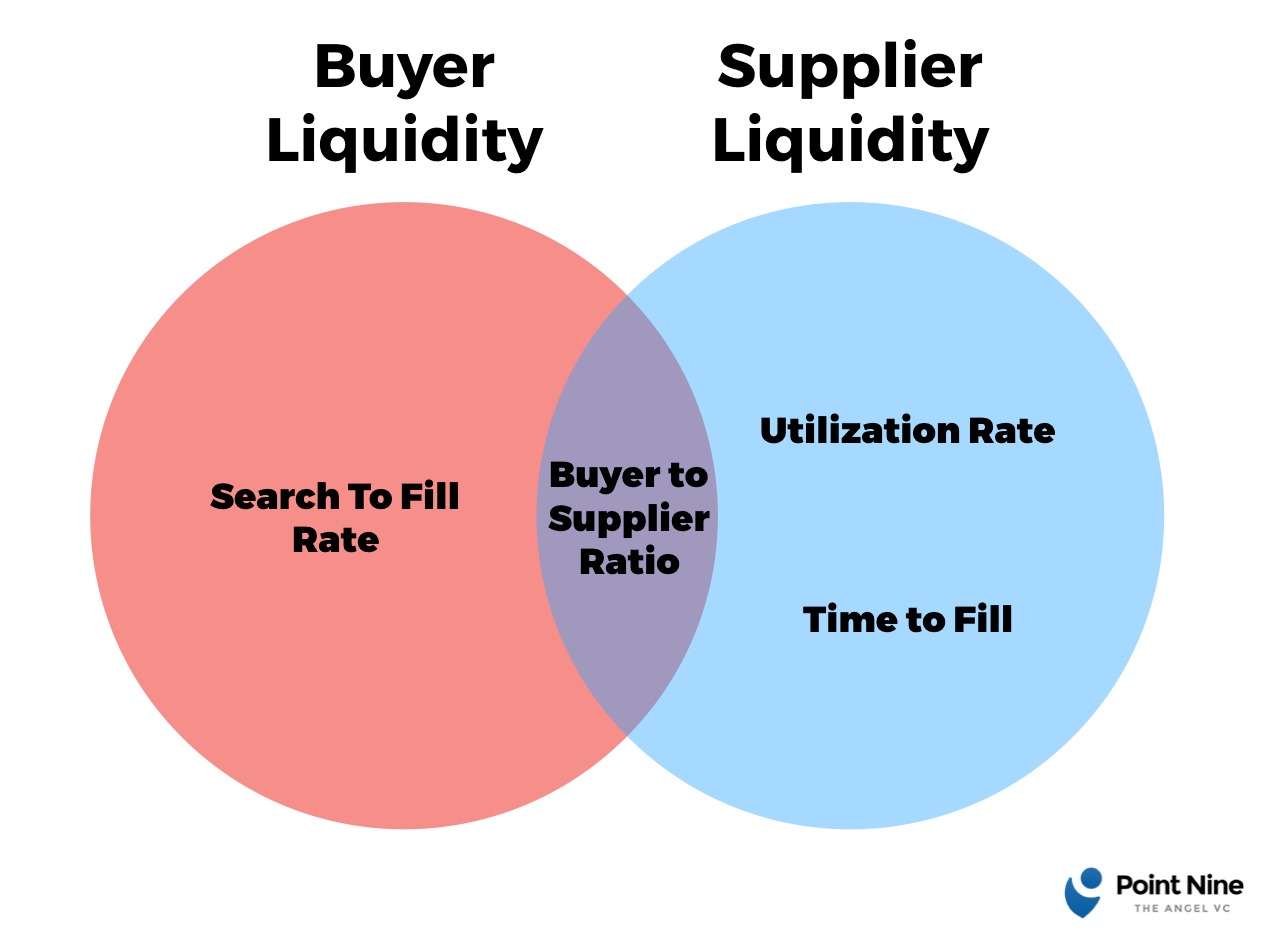

What Makes a Marketplace Thrive? Unpacking the Liquidity Model

Understanding what makes a marketplace thrive requires a deep dive into the liquidity model, which is central to its success. At its core, liquidity refers to the ease with which assets can be bought and sold in the marketplace without affecting their price. A thriving marketplace efficiently aligns supply and demand, ensuring that buyers can find what they need quickly while sellers are able to reach a broad audience. Key factors that influence liquidity include the number of participants, the range of products or services offered, and the efficiency of the transaction process. Thus, fostering an active participant base is critical for enhancing marketplace liquidity.

Moreover, marketplace platforms must implement features that encourage fluid interactions among users. For instance, offering transparent pricing, secure payment options, and robust customer support can significantly enhance user experience, leading to higher retention rates. Additionally, incorporating user-generated content, such as reviews and ratings, not only builds trust but also attracts new participants by assisting them in making informed decisions. By continuously refining these elements, marketplaces can create an environment where liquidity thrives and participants engage more actively, ultimately leading to sustainable growth.